Review: Michael Tomz & Mark L.J. Wright, 2013. “Empirical Research on Sovereign Debt and Default,” Annual Review of Economics, Annual Reviews, vol. 5(1), pages 247-272, 05.)

——-

International observers have been warning of a possible Venezuelan default for years, yet contrary to what is generally believed, the Venezuelan governments of Chavez and Maduro have been reliable, always paying bondholders on time. Still, after President Maduro’s decision to radicalize his economic policy after the election — instead of, as some had hoped, normalize it — even optimists are beginning to doubt Venezuela’s capacity to service its foreign debt in the coming months. After inflation of around 275% in 2015, the IMF expects the rate to reach 720% in 2016, higher than any other country in the world. Considering the political deadlock in Caracas, the institution also forecasts the Venezuelan economy to contract by a staggering 18% over 2015 and 2016.

Considering that Venezuela’s current government would refuse to work with the IMF, one of the world’s leading sovereign debt restructuring lawyers has warned that Venezuela would face an Argentina-style legal drama if it defaults. The situation may be even more complicated since the Venezuelan government has signed a series of financial agreements with China over the past years, which makes Beijing senior to other creditors (like bondholders), thus turning Venezuela into a risky place to borrow for years to come (because China collects its oil before Venezuela sells it elsewhere).

Interestingly enough, the policy debates about the significance and consequences of a potential Venezuelan default are often uninformed and lack historical context to provide some much-needed perspective. In this context, Michael Tomz of Stanford University and Mark Wright of the Federal Reserve Bank of Chicago have written a very instructive paper which looks at the long history of sovereign debt and the risk and repercussions of default.

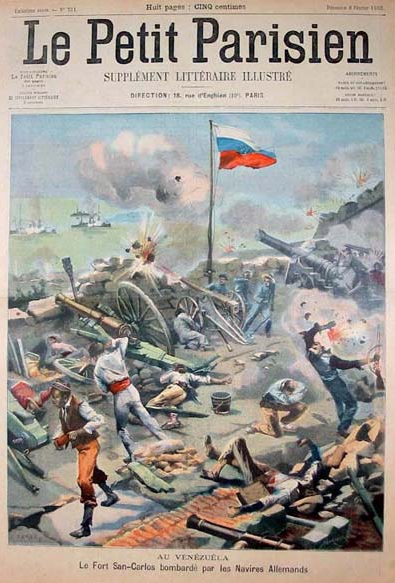

The non-specialist observer will be surprised to learn that, with sovereign debt accounting around one fifth of global financial assets, sovereign defaults are rather common. There were 248 external defaults by 107 distinct entities. The most frequent defaulters were Ecuador, Mexico, Uruguay, and Venezuela; each experienced at least 8 distinct spells of default. Famously, in 1902, the Venezuelan Crisis erupted, when Britain, Germany and Italy imposed a naval blockade in reaction to President Cipriano Castro’s refusal to pay foreign debts.

A cover of the “Le Petit Parisien” depicting the bombardment of Fort San Carlos in Lake Maracaibo by the Imperial German Navy

Ecuador and Honduras, in turn, have each spent more than 120 years in default, beginning with their initial loans as members of the Central American Confederation in the 1820s, and Greece has been in default for more than 90 years. The largest default in history (by present value) was the 2012 Greek restructuring that covered more than €200b of privately held debt, followed by Argentina in 2001 and Russia in 1918.

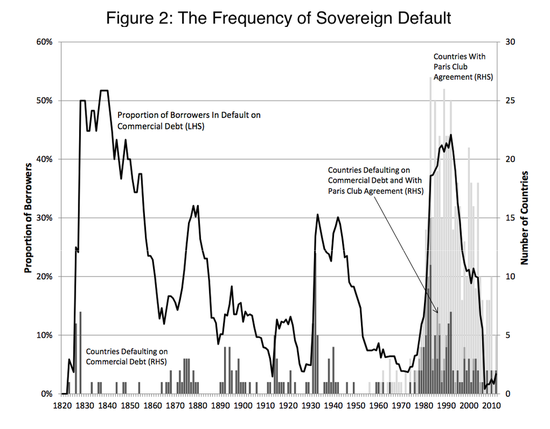

The figure reveals four episodes in which at least 30% of the worlds’ debtors (by number) have been in default, giving rise to the notion of a global default crisis (see figure 2 below). The first episode began in the 1820s, when a number of newly independent countries issued debt and immediately defaulted. The second episode, occurring in the 1870s, was associated with wars in Central and South America, followed by a fall in commodity prices. The third episode centers on the Great Depression, and the fourth is the global debt crisis of the 1980s.

One way to predict what would happen after a Venezuelan default is to study the aftermath of Argentina’s default in 2001, which continues to profoundly affect Argentina’s role in the global economy 15 years later. The mean length of a default across the entire sample of the paper is only 9.9 years, dropping to 7.8 years for the period since 1970. Being in default is associated with less market access, with the average country taking 4.7 years to re-access markets following a default, declining to 2.9 years more recently. However, the authors note that unstructured defaults, as was the case with Argentina in 2001, cause longer interruptions. The ability to borrow after a default was regained quickly in cases of “excusable defaults” like natural disasters — a case that, of course, would not apply to Venezuela.

Two mistakes can be heard frequently when default scenarios are discussed. One is that all the creditors will lose all their money. As Tomz and Wright show, the historical average “haircut” — e.g. the money that will effectively never be repaid — is between 38% and 50% (and 87% for some highly indebted poor nations). The other mistake — a consequence of the first — is that a default is seen as a means of drawing a line under financial troubles and starting anew. As the authors show, indebtedness, measured by the ratio of the face value of debt to GDP, does not fall and may even rise after a default. The median country ends the year of the settlement with a debt-to-GDP ratio 5 percentage points higher than when they entered default. The increases in indebtedness are largest for low income countries.

Finally, the authors argue that “default could signal that the government is unreliable, not just in debt, but in international affairs more generally. Foreigners might, therefore, be less willing to make direct investments or enter into trade agreements, environmental pacts, and military alliances with the offending state.” Given how little foreign investors know about the differences between South American governments, this should worry policy makers in Brasília, Lima and elsewhere, as Venezuela’s default — as did Argentina’s 15 years ago — would negatively affect the continent’s image.

Even though Tomz and Wright do not make any reference to Venezuela’s current plight, their evidence suggests that declaring default would probably not represent the end of Venezuela’s suffering (or even create a light at the end of the tunnel), but rather be little more than the transition to another phase of the country’s financial woes.

Read also:

Brazil and Argentina must prepare joint plan as Venezuelan debt default looms

Brazil’s top 10 foreign policy challenges in 2016

What’s next for Venezuela? Sinophobia

Photo credits : Forbes